SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filedby a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Stoneridge, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

Not Applicable

| (2) | Form, Schedule or Registration Statement No.: |

Not Applicable

| (3) | Filing Party: |

Not Applicable

| (4) | Date Filed: |

Not Applicable

STONERIDGE, INC.

9400 East Market Street

Warren, Ohio 44484

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Dear Shareholder:

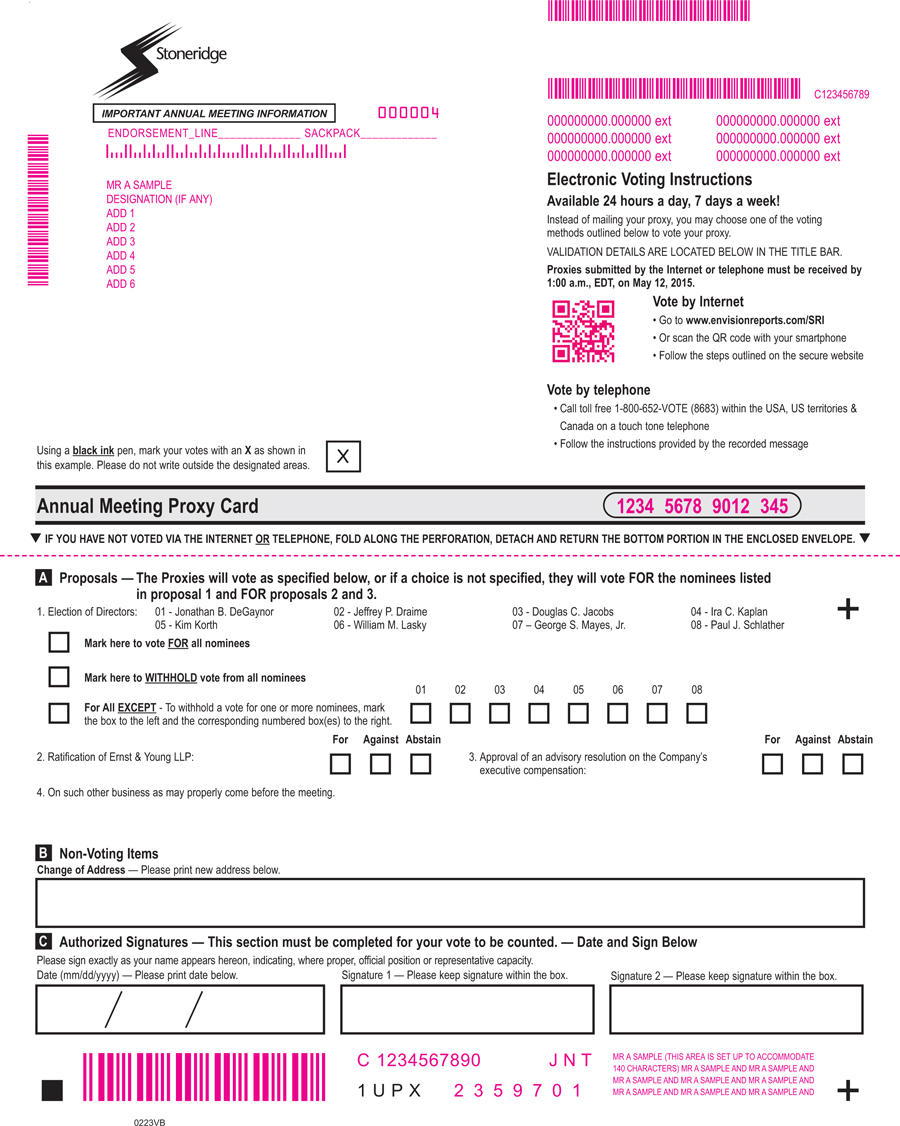

We will hold our 20142015 Annual Meeting of Shareholders on Tuesday, May 6, 2014,12, 2015, at 11:00 a.m. Eastern Time, at the Sheraton Cleveland Airport Marriott, 4277 West 150th Street,Hotel, 5300 Riverside Drive, Cleveland, Ohio 44135.

The purpose of the Annual Meeting is to consider and vote on the following matters:

| 1. | Election of eight directors, each for a term of one year; |

| 2. | Ratification of the appointment of Ernst & Young LLP; |

| 3. | An advisory vote on executive compensation; and |

| 4. | Any other matters properly brought before the meeting. |

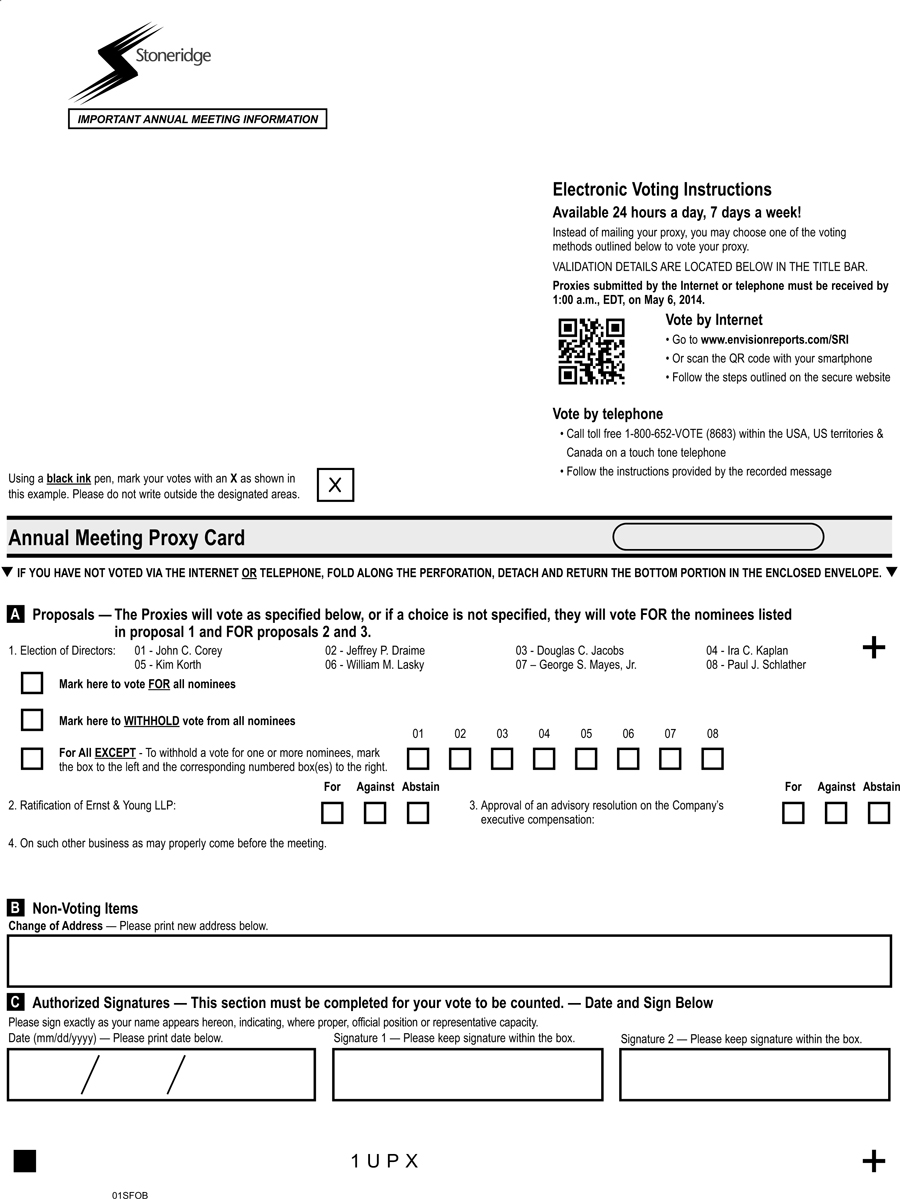

Only shareholders of record at the close of business on March 31, 2014,2015 are entitled to notice of and to vote at the meeting or any adjournment thereof. Shareholders are urged to complete, sign and date the enclosed proxy and return it in the enclosed envelope or to vote by telephone or Internet.

| By order of the Board of Directors, | |

| |

| ROBERT M. LOESCH, | |

| Secretary |

Dated: April 7, 201410, 2015

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 6, 2014:12, 2015:

This Proxy Statement and the Company’s 20132014 Annual Report to Shareholders are also available atwww.edocumentview.com/sri.

YOUR VOTE IS IMPORTANT.

PLEASE SUBMIT YOUR PROXY BY COMPLETING AND MAILING THE ENCLOSED PROXY CARD OR PROVIDE YOUR VOTE BY TELEPHONE OR INTERNET.

STONERIDGE, INC.

20142015 Proxy Statement Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. We are mailing this Proxy Statement to our shareholders on or about April 7, 2014,10, 2015, and it is also available online atwww.edocumentview.com/sri. The Board of Directors is soliciting proxies in connection with the 20142015 Annual Meeting of Shareholders and encourages you to read thisthe Proxy Statement and vote your shares online, by telephone or by mailing your proxy card or voting instruction form.

Stoneridge, Inc. 20142015 Annual Meeting Information

| · | Date and Time: Tuesday, May |

| · | Location: Sheraton Cleveland Airport |

| · | Record Date: March 31, |

| · | Voting: Shareholders as of the record date are entitled to vote. Each share of common shares is entitled to one vote for each Director nominee and one vote for each of the other proposals to be voted on. |

Matters to be Considered:

| Management Proposals | Board Vote Recommendation | Page (for more information) | ||||

| 1. Elect eight directors named in this Proxy Statement | FOR ALL | 5 | ||||

| 2. Ratification of the appointment of Ernst & Young LLP | FOR | 8 | ||||

| 3. Advisory vote on executive compensation | FOR | 10 |

Company Performance

(In thousands, except earnings per share2014 was a year of transformation for the Company. We sold our Wiring business and share price)refinanced our debt enabling us to shift our focus towards growing our remaining technology-driven business segments with a more flexible and lower cost structure. Our operating performance declined from the prior year primarily due to a non-cash goodwill impairment charge related to our PST segment, a loss on the extinguishment of debt, weakness in the Brazilian economy and automotive markets, and unfavorable changes in foreign currency exchange rates.

| 2013 | 2012 | Percent Change | ||||||||||

| Net Sales | $ | 947,830 | $ | 938,513 | 1.0 | % | ||||||

| Operating Income | 39,704 | 28,729 | 38.2 | % | ||||||||

| Net Income | 15,131 | 5,361 | 182.2 | % | ||||||||

| Earnings Per Share, Diluted | $ | 0.56 | $ | 0.20 | 180.0 | % | ||||||

| Share Price at 12/31 | $ | 12.75 | $ | 5.12 | 149.0 | % | ||||||

| (In thousands, except earnings per share and share price) | 2014 | 2013 | ||||||

| Net sales | $ | 660,579 | $ | 659,486 | ||||

| Operating income (loss) | (25,823 | ) | 42,403 | |||||

| Income (loss) from continuing operations | (51,204 | ) | 20,529 | |||||

| Loss from discontinued operations | (9,387 | ) | (4,021 | ) | ||||

| Net income (loss) attributable to Stoneridge, Inc. | (47,108 | ) | 15,131 | |||||

| Diluted earnings (loss) per share from continuing operations attributable to Stoneridge, Inc. | $ | (1.40 | ) | $ | 0.70 | |||

| Diluted loss per share from discontinued operations | $ | (0.35 | ) | $ | (0.14 | ) | ||

| Diluted earnings (loss) per share attributable to Stoneridge, Inc. | $ | (1.75 | ) | $ | 0.56 | |||

| Share Price at December 31 | $ | 12.86 | $ | 12.75 | ||||

Net sales increased slightly as a result of higher sales in our Electronics and Control Devices segments which were substantially offset by $9.3lower product sales volumes and unfavorable foreign currency translation at our PST segment.

Loss from continuing operations includes a $51.5 million non-cash goodwill impairment charge related our PST segment and net income increased by $9.8loss on extinguishment of debt of $10.6 million in 2013 compared with 2012 and our closing share price at year end 2013 increased 149% from a year earlier. These improved results are worth noting, however, they were below our consolidated financial performance expectations forrelated to the year. Sales performancerefinancing. Our profitability was below our growth targets and wasfurther negatively impacted by continuing weak trends in the commercial vehicle markets, market share loss by a significant customer and currency devaluation of the Brazilian real, which were partially offset by continued growth in the North American automotive markets and new program awards in Europe.

Profitability, while significantly above the prior year on a modest revenue increase, was below expectations for 2013higher material costs due to unfavorable volume, exchange rate fluctuations, operational performancechanges in foreign currencies and an unfavorable mix of products sold in our Wiring segment,Electronics and changes in product mix in our PST segment all of which reduced marginal contributions. Partially offsetting these impacts were reductions in selling, general and administrative costs.segments.

| i |

Director Nominees

Stoneridge’s Directors are elected for one-year terms by a majority of the votes cast.terms. Below is a summary of the Director nominees. Additional information about each director nominee and his or her qualifications may be found beginning on page 5 of this Proxy Statement.

| Committee Memberships | Committee Memberships | |||||||||||||||||||||||||||

| Name | Age | Director Since | Primary Occupation | Independent | AC | CC | NCGC | Age | Director Since | Primary Occupation | Independent | AC | CC | NCGC | ||||||||||||||

| John C. Corey | 66 | 2004 | President and CEO of Stoneridge, Inc. | |||||||||||||||||||||||||

| Jonathan B. DeGaynor | 48 | - | President and CEO of Stoneridge, Inc. | |||||||||||||||||||||||||

| Jeffrey P. Draime | 47 | 2005 | Self-employed business consultant | ü | ü | ü | 48 | 2005 | Self-employed business consultant | ü | ü | ü | ||||||||||||||||

| Douglas C. Jacobs | 74 | 2004 | Executive Vice President-Finance and CFO of Brooklyn NY Holdings, LLC | ü | C | ü | 75 | 2004 | Executive Vice President-Finance and CFO of Brooklyn NY Holdings, LLC | ü | C | ü | ||||||||||||||||

| Ira C. Kaplan | 60 | 2009 | Managing Partner of Benesch, Friedlander, Coplan & Arnoff LLP | ü | ü | ü | 61 | 2009 | Executive Chairman of Benesch, Friedlander, Coplan & Aronoff LLP | ü | ü | ü | ||||||||||||||||

| Kim Korth | 59 | 2006 | President and CEO of Dickten Masch Plastics, LLC and TECHNIPLASTM | ü | C | ü | 60 | 2006 | President and CEO of Dickten Masch Plastics, LLC and TECHNIPLASTM | ü | C | ü | ||||||||||||||||

| William M. Lasky | 66 | 2004 | Former President and CEO of Accuride Corporation | L | ü | ü | C | 67 | 2004 | Former President and CEO of Accuride Corporation | L | ü | ü | C | ||||||||||||||

| George S. Mayes, Jr. | 55 | 2012 | Executive Vice President and COO of Diebold, Inc. | ü | ü | 56 | 2012 | Executive Vice President and COO of Diebold, Inc. | ü | ü | ||||||||||||||||||

| Paul J. Schlather | 61 | 2009 | Self-employed business consultant | ü | ü | 62 | 2009 | Self-employed business consultant | ü | ü | ||||||||||||||||||

| AC | Audit Committee | C | Committee Chairperson | |||

| CC | Compensation Committee | L | Lead Independent Director | |||

| NCGC | Nominating |

Ratification of the appointment of Ernst & Young LLP

As a matter of good governance, weWe are asking our shareholders to ratify the appointment of Ernst & Young LLP to serve as our independent registered public accounting firm for the year ending December 31, 2014. Below is summary information with respect to2015. The table below summarizes the fees billed to us for services provided to us during the years ended December 31, 20132014 and 2012.2013. For more information, see page 8 of this Proxy Statement.

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| Audit Fees | $ | 1,654,130 | $ | 1,454,846 | $ | 1,810,555 | $ | 1,654,130 | ||||||||

| Tax Fees | 380,200 | 463,896 | 157,777 | 380,200 | ||||||||||||

| Total Fees | $ | 2,034,330 | $ | 1,918,742 | $ | 1,968,332 | $ | 2,034,330 | ||||||||

| ii |

Executive Compensation Highlights

Our executive compensation program is designed to attract, retain, motivate and reward talented executives who advance our strategic, operational and financial objectives and, thereby, enhance shareholder value. The primary objectives of our compensation programs for executive officers are to:

| · | Attract and retain talented executive officers by providing a compensation package that is competitive with that offered by similarly situated companies; |

| · | Create a compensation structure under which a substantial portion of total compensation is based on achievement of performance goals; and |

| · | Align total compensation with the objectives and strategies of our business and shareholders. |

Key elements of our 20132014 compensation program are as follows:

| · | Base Salary. Base salary has been targeted at the 50th percentile of our peer group. |

| · | Annual Incentive Plan (AIP). The |

| · | Long-Term Incentive Plans. Long-term incentives were awarded under our Long-Term Incentive Plan |

Additionally, during 2013, we implemented a Share Ownership policy for our executive officers whereby the CEO, CFO and other executive officers must retain our common shares equal in market value to five, four and three times, respectively, their annual base salaries.

For more information related to our executive compensation program, see page 15 of this Proxy Statement.

| iii |

STONERIDGE, INC.

PROXY STATEMENT

The Board of Directors (the “Board”) of Stoneridge, Inc. (the “Company”) is sending you this Proxy Statement to ask for your vote as a Stoneridge shareholder on certain matters to be voted on at our Annual Meeting of Shareholders to be held on Tuesday, May 6, 2014,12, 2015, at 11:00 a.m. Eastern Time, at the Sheraton Cleveland Airport Marriott, 4277 West 150th Street,Hotel, 5300 Riverside Drive, Cleveland, Ohio 44135. This Proxy Statement and the accompanying notice and proxy will be mailed to you on or about April 7, 2014.10, 2015.

Annual Report; Internet Availability

A copy of our Annual Report to Shareholders for the fiscal year ended December 31, 2013,2014, is enclosed with this Proxy Statement. Additionally, this Proxy Statement and our Annual Report to Shareholders for the fiscal year ended December 31, 20132014 are available atwww.edocumentview.com/sri.

Solicitation of Proxies

The Board is making this solicitation of proxies and we will pay the cost of the solicitation. We have retained Georgeson Inc., at an estimated cost of $8,000, to assist in the solicitation of proxies from brokers, nominees, institutions and individuals. In addition to the solicitation of proxies by mail by Georgeson Inc., our employees may solicit proxies by telephone, facsimile or electronic mail.

Proxies; Revocation of Proxies

The common shares represented by your proxy will be voted in accordance with the instructions as indicated on your proxy. In the absence of any such instructions, they will be voted to (a) elect the director nominees set forth under “Election of Directors”; (b) ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014;2015; and (c) approve the compensation paid toof our Named Executive Officers. Your presence at the Annual Meeting of Shareholders, without further action, will not revoke your proxy. However, you may revoke your proxy at any time before it has been exercised by (i) signing and delivering a later-dated proxy or byproxy; (ii) giving notice to the Company in writing at our address indicated on the attached Notice of Annual Meeting of ShareholdersShareholders; or (iii) in the open meeting. If you hold your common shares in “street name”, in order to change or revoke your voting instructions you must follow the specific voting directions provided to you by your bank, broker or other holder of record.

Voting Eligibility

Only shareholders of record at the close of business on the record date, March 31, 2014,2015, are entitled to receive notice of the Annual Meeting of Shareholders and to vote the common shares held on the record date at the meeting. On the record date, our outstanding voting securities consisted of 28,330,03128,017,385 common shares, without par value, each of which is entitled to one vote on each matter properly brought before the meeting.

Voting Procedures

If you are a record holder:

| · | You may vote by mail: Complete and sign your proxy card and mail it in the enclosed, prepaid and addressed envelope. |

| · | You may vote by telephone: Call toll-free 1-800-652-VOTE (8683) on a touch-tone phone and follow the instructions. You will need your proxy card available if you vote by telephone. |

| · | You may vote by Internet: Accesswww.envisionreports.com/sri and follow the instructions. You will need your proxy card available if you vote by Internet. |

| · | You may vote in person at the meeting, however, you are encouraged to vote by mail, telephone or Internet even if you plan to attend the meeting. |

If you are a “street name” holder:

| · | You must vote your common shares through the procedures established by your bank, broker, or other holder of record. Your bank, broker, or other holder of record has enclosed or otherwise provided a voting instruction card for you to use in directing the bank, broker, or other holder of record how to vote your common shares. |

| · | You may vote at the meeting, however, to do so you will first need to ask your bank, broker or other holder of record to furnish you with a legal proxy. You will need to bring the legal proxy with you to the meeting and hand it in with a signed ballot that you can request at the meeting. You will not be able to vote your common shares at the meeting without a legal proxy and signed ballot. |

| 2 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common shares as of February 28, 2014,2015 by: (a) our directors and nominees for election as directors; (b) each other person who is known by us to own beneficially more than 5% of our outstanding common shares; (c) the executive officers named in the Summary Compensation Table; and (d) all of our executive officers and directors as a group.

| Name of Beneficial Owner | Number of Shares Beneficially Owned(1) | Percent Of Class | ||||||

| Systematic Financial Management, LP(2) | 2,557,890 | 9.0 | % | |||||

| The Goldman Sachs Group, Inc. (3) | 2,005,111 | 7.1 | ||||||

| BlackRock, Inc.(4) | 1,858,860 | 6.6 | ||||||

| JPMorgan Chase & Co.(5) | 1,430,300 | 5.0 | ||||||

| John C. Corey(6) | 821,938 | 2.9 | ||||||

| Jeffrey P. Draime(7) | 403,514 | 1.4 | ||||||

| George E. Strickler(8) | 338,429 | 1.2 | ||||||

| Thomas A. Beaver(9) | 160,181 | * | ||||||

| William M. Lasky(10) | 110,880 | * | ||||||

| Michael D. Sloan(11) | 110,105 | * | ||||||

| Richard P. Adante(12) | 97,900 | * | ||||||

| Paul J. Schlather(13) | 89,877 | * | ||||||

| Ira C. Kaplan(14) | 39,952 | * | ||||||

| Douglas C. Jacobs(15) | 35,160 | * | ||||||

| Kim Korth(16) | 29,900 | * | ||||||

| George S. Mayes, Jr.(17) | 18,420 | * | ||||||

| All Executive Officers and Directors as a Group (15 persons) | 2,295,656 | 8.1 | % | |||||

| Name of Beneficial Owner | Number of Shares Beneficially Owned (1) | Percent Of Class | ||||||

| NWQ Investment Management Company, LLC (2) | 2,844,477 | 10.2 | % | |||||

| Pzena Investment Management, LLC. (3) | 2,313,934 | 8.3 | ||||||

| The Goldman Sachs Group, Inc. (4) | 2,209,537 | 7.9 | ||||||

| BlackRock, Inc. (5) | 1,729,029 | 6.2 | ||||||

| JPMorgan Chase & Co. (6) | 1,428,414 | 5.1 | ||||||

| John C. Corey (7) | 607,847 | 2.2 | ||||||

| Jeffrey P. Draime (8) | 413,514 | 1.5 | ||||||

| George E. Strickler (9) | 306,840 | 1.1 | ||||||

| Thomas A. Beaver (10) | 137,073 | * | ||||||

| William M. Lasky (11) | 100,880 | * | ||||||

| Michael D. Sloan (12) | 93,481 | * | ||||||

| Paul J. Schlather (13) | 89,877 | * | ||||||

| Richard P. Adante (14) | 84,950 | * | ||||||

| Ira C. Kaplan (15) | 39,952 | * | ||||||

| Douglas C. Jacobs (16) | 35,160 | * | ||||||

| Kim Korth (17) | 29,900 | * | ||||||

| George S. Mayes, Jr. (18) | 18,420 | * | ||||||

| Jonathan B. DeGaynor | - | * | ||||||

| All Executive Officers and Directors as a Group (15 persons) | 1,995,899 | 7.1 | % | |||||

_______________________

* Less than 1%.

| (1) | Unless otherwise indicated, the beneficial owner has sole voting and investment power over such common shares. |

| (2) | According to a Schedule 13G filed with the Securities and Exchange Commission (“SEC”) by |

| (3) | According to a Schedule 13G filed with the SEC by Pzena Investment Management, LLC. The address of Pzena Investment Management, LLC is 120 West 45th Street, 20th Floor, New York, New York 10036. |

| (4) | According to a Schedule 13G filed with the SEC by The Goldman Sachs Group, Inc., the filing reflects the securities beneficially owned by certain operating units (collectively the “Goldman Sachs Reporting Units”) of Goldman Sachs Group, Inc. and its subsidiaries and affiliates. The Goldman Sachs Reporting Units disclaims beneficial ownership of the securities beneficially owned by (i) any client accounts with respect to which the Goldman Sachs Reporting Units or their employees have voting or investment discretion or both, or with respect to which there are limits on their voting or investment authority or both and (ii) certain investment entities of which Goldman Sachs Reporting Units act as the general partner, managing general partner or other manager, to the extent interests in such entities are held by persons other than the Goldman Sachs Reporting Units. The address of The Goldman Sachs Group, Inc. is 200 West Street, New York, New York 10282. |

| According to a Schedule 13G filed with the SEC by BlackRock, Inc. The address of BlackRock, Inc. is |

| According to a Schedule 13G filed with the SEC by JPMorgan Chase & Co. The address of JPMorgan Chase & Co. is 270 Park Avenue, New York, New York 10017. |

| Represents |

| Represents 347,714 common shares held in trust for the benefit of Draime family members, of which Mr. Draime is trustee |

| Represents |

| Represents |

| Represents |

| Represents |

| (13) | Represents |

| (14) | Represents |

| (15) | Represents 39,952 common shares owned by Mr. Kaplan directly. |

| Represents |

| Represents |

| Represents |

| 4 |

PROPOSAL ONE: ELECTION OF DIRECTORS

In accordance with the Company’s Amended and Restated Code of Regulations, the number of directors has been fixed at eight. At the Annual Meeting of Shareholders, shareholders will elect eight directors to hold office until our next Annual Meeting of Shareholders and until their successors are elected and qualified. The Board proposes that the nominees identified below be elected to the Board. John C. Corey,Jonathan B. DeGaynor, the Company’s new President and Chief Executive Officer, has an employment agreement with the Company which provides that during the term of the agreement, Mr. CoreyDeGaynor shall be entitled to be nominated for election to the Board. Mr. Corey was the Company’s President and Chief Executive Officer through March 30, 2015 and is expected to continue to serve as a director until the Annual Meeting of Shareholders. He was not nominated by the Board for re-election in 2015. At our Annual Meeting of Shareholders, the common shares represented by proxies, unless otherwise specified, will be voted for the election of the eight nominees hereinafter named.

The director nominees are identified below. If for any reason any of the nominees is not a candidate when the election occurs (which is not expected), the Board expects that proxies will be voted for the election of a substitute nominee designated by the Board. The following information is furnished with respect to each person nominated for election as a director.

The Board of Directors recommends that you vote FOR the following nominees.

Nominees to Serve for a One-Year Term Expiring in 20152016

| Mr.

| |

Jeffrey P. Draime

| Mr. Draime,

Mr. Draime served in various roles with the Company from 1988 through 2001, including operations, sales, quality control, product costing, and marketing. Since 2012, Mr. Draime has served as a director of Servantage Dixie Sales, Inc., an independent, full service, value added distributor serving consumer products markets. The Company believes that Mr. Draime should serve as a director because he provides an historical as well as an internal perspective of our business to the Board and strengthens the Board’s collective qualifications, skills and experience. Mr. Draime’s father, D.M. Draime, was the founder of Stoneridge. |

| Douglas C. Jacobs | Mr. Jacobs, privately held investment advisory company established to manage the assets of a family and family trust. Prior to serving in this position, from 1999 until 2005 Mr. Jacobs held various financial positions with the Cleveland Browns. Mr. Jacobs is a former partner of Arthur Andersen LLP.

Mr. Jacobs has served as a director of Standard Pacific Corporation, a national residential home builder in southern California, since 1998 and serves as Chairman of the Audit Committee and a member of the Compensation, Executive and Nominating and Corporate Governance Committees. Mr. Jacobs is a member of the boards of SureFire, Inc., a manufacturer of high-performance flashlights, weapon-mounted lights and other tactical equipment, and M/G Transport Services LLC, a barge line and inland waterways carrier.

Mr. Jacobs qualifies as an audit committee financial expert due to his extensive background in accounting and finance built through his career in public accounting. In addition to his professional and accounting experience described above, the Company believes that Mr. Jacobs should serve as a director because he provides valuable business experience and judgment to the Board, which strengthens the Board’s collective qualifications, skills and experience.

| |

| ||

Ira C. Kaplan

| Mr. Kaplan,

Mr. Kaplan counsels clients in governance and business matters in his role at the law firm. In addition to his legal and management experience described above, the Company believes that Mr. Kaplan should serve as a director because he brings thoughtful analysis, sound judgment and insight to best practices to the Board, in addition to his professional experiences, which strengthens the Board’s collective qualifications, skills and experience.

| |

Kim Korth

| Ms. Korth,

Ms. Korth is a member of the Ms. Korth has several decades of experience in corporate governance issues, organizational design, and development of strategies for growth and improved financial performance for automotive suppliers. In addition to the knowledge and experience described above, the Company believes that Ms. Korth should serve as a director because she provides insight to industry trends and expectations to the Board, which strengthens the Board’s collective qualifications, skills and experience.

|

William M. Lasky

| Mr. Lasky,

Since 2011 Mr. Lasky has served as a director of Affinia Group, Inc., a designer, manufacturer and distributor of industrial grade replacement parts and services for automotive and heavy-duty vehicles.

In addition to his professional experience described above, the Company believes that Mr. Lasky should serve as a director because he provides in-depth industry knowledge, business acumen and leadership to the Board, which strengthens the Board’s collective qualifications, skills and experience. | |

George S. Mayes, Jr.

| Mr. Mayes,

Mr. Mayes has extensive experience in lean manufacturing and Six Sigma processes and has managed manufacturing facilities in Canada, Mexico, France, Hungary, Brazil, China, Poland, Italy and the United States.

The Company believes that Mr. Mayes should serve as a director because he provides in depth knowledge of manufacturing theories and operations, business acumen and leadership to the Board, which strengthens the Board’s collective qualifications, skills and experience.

| |

Paul J. Schlather

| Mr. Schlather,

Mr. Schlather qualifies as an audit committee financial expert due to his extensive background in accounting and finance built through his career in public accounting. In addition to his professional and accounting experience described above, the Company believes that Mr. Schlather should serve as a director because he provides financial analysis and business acumen to the Board, which strengthens the Board’s collective qualifications, skills and experience.

|

| 7 |

PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

The Audit Committee of the Board currently expects to appoint Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm for the year ending December 31, 2014.2015. For 2013,2014, Ernst & Young was engaged by us to audit our annual financial statements, assess our internal control over financial reporting and to perform audit-related and tax services. We expect that representatives of Ernst & Young will be present at the Annual Meeting of Shareholders, will have an opportunity to make a statement if they so desire, and are expected to be available to respond to appropriate questions from shareholders.

The Board seeks an indication from our shareholders of their approval or disapproval of the Audit Committee’s anticipated appointment of Ernst & Young as our independent registered public accounting firm for the 20142015 fiscal year. The submission of this matter for approval by shareholders is not legally required, however, the Board believes that the submission is an opportunity for the shareholders to provide feedback to the Board on an important issue of corporate governance. If our shareholders do not approve the appointment of Ernst & Young, the appointment of our independent registered public accounting firm will be re-evaluated by the Audit Committee but will not require the Audit Committee to appoint a different accounting firm. If our shareholders do approve the appointment of Ernst & Young, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of the Company and its shareholders. Approval of this proposal requires the affirmative vote of a majority of the common shares present in person or by proxy and entitled to be voted on the proposal at our Annual Meeting of Shareholders. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be considered common shares present and entitled to vote on the proposal and will not have a positive or negative effect on the outcome of this proposal, however, there should be no broker non-votes on this proposal because brokers should have the discretion to vote uninstructed common shares on this proposal.

The Board of Directors recommends that you vote FOR Proposal Two.

Service Fees Paid to the Independent Registered Public Accounting Firm

The following table sets forth the aggregate fees billed by and paid to Ernst & Young by fee category for the fiscal years ended December 31, 20132014 and 2012.2013. The Audit Committee has considered the scope and fee arrangements for all services provided by Ernst & Young, taking into account whether the provision of non-audit-related services is compatible with maintaining Ernst & Young’s independence.

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| Audit Fees | $ | 1,654,130 | $ | 1,454,846 | $ | 1,810,555 | $ | 1,654,130 | ||||||||

| Tax Fees | 380,200 | 463,896 | 157,777 | 380,200 | ||||||||||||

| Total Fees | $ | 2,034,330 | $ | 1,918,742 | $ | 1,968,332 | $ | 2,034,330 | ||||||||

Audit Fees.Audit fees include fees associated with the annual audit of our financial statements, the assessment of our internal control over financial reporting as integrated with the annual audit of our financial statements, the quarterly reviews of the financial statements included in our SEC Form 10-Q filings, statutory and regulatory audits and general assistance with the implementation of new regulatory pronouncements.

Tax Fees.Tax fees relate to tax compliance and both domestic and international tax advisory services.

Pre-Approval Policy

The Audit Committee’s policy is to approve in advance all audit and permitted non-audit services to be performed for the Company by its independent registered public accounting firm. Pre-approval is generally provided for up to one year, is detailed as to the particular service or category of services and is generally subject to a specific budget. The Audit Committee also pre-approves particular services on a case-by-case basis. In accordance with this policy, the Audit Committee has delegated pre-approval authority to the Chairman of the Audit Committee. The Chairman may pre-approve services and then inform the Audit Committee at the next scheduled meeting.

All services provided by Ernst & Young during fiscal year 2013,2014, as noted in the previous table, were authorized and approved by the Audit Committee in compliance with the pre-approval policies and procedures described above.

| 8 |

Audit Committee Report

In accordance with its written charter, the Audit Committee assists the Board in fulfilling its responsibility relating to corporate accounting, our reporting practices, and the quality and integrity of the financial reports and other financial information provided by us to any governmental body or to the public. Management is responsible for the financial statements and the financial reporting process, including assessing the systemeffectiveness of the Company’s internal controls.control over financial reporting. The independent registered public accounting firm is responsible for conducting audits and reviews of our financial statements in accordance with standards established by the Public Company Accounting Oversight Board, expressing an opinion on our auditedthe conformity of the Company’s financial statements in accordance with generally accepted accounting principles, and auditsauditing and reporting on the Company’s effectiveness of our internal control over financial reporting. The Audit Committee is comprised of five directors, each of whom is “independent” for audit committee purposes under the listing standards of the New York Stock Exchange (“NYSE”).

In discharging its oversight responsibility as to the audit process, the Audit Committee reviewed and discussed our audited financial statements for the year ended December 31, 2013,2014, with management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements. The Audit Committee also discussed with our independent registered public accounting firm, Ernst & Young, the matters required to be discussed by Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has received the written disclosures and letter from Ernst & Young required by the applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young’s communication with the Audit Committee concerning independence. The Audit Committee discussed Ernst & Young’s independence with Ernst & Young. The Audit Committee also considered whether the provision of non-audit services by Ernst & Young is compatible with maintaining Ernst & Young’s independence. Management has the responsibility for the preparation of our financial statements and Ernst & Young has the responsibility for the examination of those statements.

The Audit Committee discussed with our internal auditoraudit director and Ernst & Young the overall scope and plans for their respective audits. The Audit Committee meetsalso met with the internal audit director and Ernst & Young, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of the Company’s financial reporting.

Based on the above-referenced review and discussions with management, the internal audit director and Ernst & Young, the Audit Committee recommended to the Board, and the Board approved, that the audited consolidated financial statements for fiscal 20132014 be included in the Company’s Annual Report on Form 10-K filed with the SEC.

| The Audit Committee | |

| Douglas C. Jacobs, Chairman | |

| Ira C. Kaplan | |

| William M. Lasky | |

| George S. Mayes, Jr. | |

| Paul J. Schlather |

| 9 |

PROPOSAL THREE: SAY-ON-PAY

The Company provides our shareholders with the opportunity to cast an annual advisory non-binding vote to approve the compensation of its Named Executive Officers as disclosed pursuant to the SEC’s compensation disclosure rules (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and the narrative disclosures that accompany the compensation tables) (a “say-on-pay proposal”). We believe that it is appropriate to seek the views of shareholders on the design and effectiveness of the Company’s executive compensation program.

At the Company’s 20132014 Annual Meeting of Shareholders, 74%73% of the votes castshares entitled to vote supported the Company’s 20132014 say-on-pay proposal. The Compensation Committee believes this affirmed shareholders’ support of the Company’s approach to executive compensation.

Our goal for the executive compensation program is to attract, motivate, and retain a talented, entrepreneurial and creative team of executives to provide operational and strategic leadership for the Company’s success in competitive markets. We seek to accomplish this goal in a way that rewards performance and is aligned with our shareholders’ long-term interests. We believe that our executive compensation program, which emphasizes performance-based compensation and long-term equity awards, satisfies this goal and is strongly aligned with the long-term interests of our shareholders.

Base compensation is aligned to be competitive in the industry in which we operate. Performance-based compensation (cash and equity) represents 60-80% of each executive officer’s target compensation opportunity, with long-term incentives representing the majority of compensation. Targets for incentive compensation are based on financial performance targets and increasing shareholder value. The Compensation Committee retains the services of an independent compensation consultant to advise on competitive compensation and compensation practices.

The Board recommends that shareholders vote FOR the following resolution:

“RESOLVED that the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

Because the vote is advisory, it will not be binding upon the Board or the Compensation Committee. The Board and the Compensation Committee value the opinions of our shareholders and will take into account the outcome of the vote when considering future executive compensation arrangements.

The affirmative vote of a majority of the common shares present or represented by proxy and voting at the annual meeting will constitute approval of this non-binding resolution. If you own common shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your common shares so that your vote can be counted on this proposal. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be considered common shares present and entitled to vote on this proposal and will not have a positive or negative effect on the outcome of this proposal.

The Board of Directors recommends that you vote FOR Proposal Three.

| 10 |

CORPORATE GOVERNANCE

Corporate Governance Documents and Committee Charters

The Company’s Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers and the charters of the Board of Directors’ Audit, Compensation, and Nominating and Corporate Governance committees are posted on our website atwww.stoneridge.com. Written copies of these documents are available without charge to any shareholder upon request. Requests should be directed to Investor Relations at ourthe address listed on the Notice of Annual Meeting of Shareholders.

Corporate Ethics Hotline

We established a corporate ethics hotline as part of our Whistleblower Policy and Procedures to allow persons to lodge complaints about accounting, auditing and internal control matters, and to allow an employee to lodge a concern, confidentially and anonymously, about any accounting and auditing matter. Information about lodging such complaints or making such concerns known is contained in our Whistleblower Policy and Procedures, which is posted on our website atwww.stoneridge.com.

Director Independence

The NYSE rules require listed companies to have a Board of Directors comprised of at least a majority of independent directors. Under the NYSE rules, a director qualifies as “independent” upon the affirmative determination by the Board of Directors that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Board has not adopted categorical standards of independence. The Board has determined that the following directors and nominees for election of director are independent:

| Jeffrey P. Draime | Kim Korth | George S. Mayes, Jr. | ||

| Douglas C. Jacobs | William M. Lasky | Paul J. Schlather | ||

| Ira C. Kaplan |

The Board of Directors’ Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the Board’s attention the most material risks to the Company. The Board has oversight responsibility of the processes established to report and monitor systems for material risks applicable to us. The Audit Committee regularly reviews enterprise-wide risk management, which includes treasury risks (commodity pricing, foreign(foreign exchange rates, and credit and debt exposures), financial and accounting risks, legal and compliance risks, and other risk management functions. The Compensation Committee considers risks related to the attraction and retention of talent and related to the design of compensation programs and arrangements. The full Board considers strategic risks and opportunities and regularly receives reports from management on risk and from the committees regarding risk oversight in their areas of responsibility.

Compensation Policies and Risk

Our policies and overall compensation practices for all employees do not create risks that are reasonably likely to have a material adverse affect on the Company. The compensation policies are generally consistent for all of our business units.

In addition, incentives are not designed, and do not create, risks that are reasonably likely to have a material adverse effect on the Company as all incentives reward growth and profitability. Our various incentive programs are based on our consistent growth and continued profitability, relying, for example, on the total return on investment, operating profit and total shareholder return. As such, they do not encourage employees to take risks to the detriment or benefit of our results in order to receive incentive compensation, nor are they reasonably likely to have a material adverse effect on the Company.

Anti-Hedging Policy

In 2013 the Board amended our Insider Trading Policy to prohibit Company directors, officers and key employees covered by the pre-clearance procedures of the Insider Trading Policy from engaging in hedging transactions designed to offset decreases in the market value of the Company’s securities, including transactions in put options, call options or other derivative securities, on an exchange or in any other organized market, prepaid variable forwards, equity swaps, collars and exchange funds.

Anti-Pledging Policy

As of the date of this Proxy Statement, there are no executive officers or directors who hold Company securities in a margin account or have Company securities pledged as collateral for a loan. In 2013 the Board amended our Insider Trading Policy to prohibit directors, officers and key employees covered by the pre-clearance provisions of the Insider Trading Policy from holding Company securities in a margin account or pledging Company securities as collateral for a loan.

The Board of Directors

In 2013,2014, the Board held eight17 meetings. Each Board member except Mr. Mayes, attended at least 75% of the meetings of the Board and of the committees on which he or she serves. Our policy is that directors are to attend the Annual Meeting of Shareholders. All of our current directors attended the 20132014 Annual Meeting of Shareholders. Mr. Lasky has been appointed as the lead independent director by the independent directors to preside at the executive sessions of the independent directors. It is the Board’s practice to have the independent directors meet regularly in executive session. All directors, except Mr. Corey, the Company’s former President and Chief Executive Officer (“CEO”), are independent.

Leadership of the Board

The Board does not have a formal policy regarding the separation of the roles of CEO and Chairman of the Board as the Board believes it is in the best interest of the Company and our shareholders to make that determination based on the position and direction of the Company and the membership of the Board. At this time, the Board has determined that having an independent director serve as Chairman is in the best interest of the Company and our shareholders. This structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing Board priorities and procedures. Further, this structure permits our President and CEO to devote more time to focus on the strategic direction and management of our day-to-day operations.

Committees of the Board

The Board has three standing committees to facilitate and assist the Board in the execution of its responsibilities. These committees are the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each member of the Audit, Compensation, and Nominating and Corporate Governance Committees is independent as defined under the listing standards of the NYSE. The table below shows the composition of the Board’s committees:

Audit

| Compensation

| Nominating and

| |||

| Douglas C. | Jeffrey P. Draime | Jeffrey P. Draime | |||

| Ira C. Kaplan | Douglas C. Jacobs | Ira C. Kaplan | |||

| William M. Lasky | Kim | Kim Korth | |||

| George S. Mayes, Jr. | William M. Lasky | William M. | |||

| Paul J. Schlather |

* Committee Chairperson

| 12 |

Audit Committee.

This committee held eight meetings in 2013.2014. Information regarding the functions performed by the Audit Committee is set forth in the “Audit Committee Report,” included in this Proxy Statement. The Board has determined that each Audit Committee member is financially literate under the listing standards of the NYSE. The Board also determined that Mr. Jacobs and Mr. Schlather each qualify as an “audit committee financial expert” as defined by the SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002. In addition, under the Sarbanes-Oxley Act of 2002 and the NYSE rules mandated by the SEC, members of the audit committee must have no affiliation with the issuer, other than their Board seat, and receive no compensation in any capacity other than as a director or committee member. Each member of the Audit Committee meets this additional independence standard applicable to audit committee members of NYSE listed companies.

Compensation Committee.

This committee held fourfive meetings in 2013.2014. Each member of our Compensation Committee meets the independence requirements of the NYSE, including the enhanced independence requirements applicable to Compensation Committee members under NYSE rules effective July 1, 2013, is a non-employee director under Rule 16b-3 of the Securities Exchange Act of 1934 and is an outside director under Section 162(m) of the Internal Revenue Code. The Compensation Committee is responsible for establishing and reviewing our compensation philosophy and programs with respect to our executive officers; approving executive officer compensation and benefits; recommending to the Board the approval, amendment and termination of incentive compensation and equity-based plans; and certain other compensation matters, including director compensation. Recommendations regarding compensation of other officers are made to the Compensation Committee by our CEO. The Compensation Committee can exercise its discretion in modifying any amount presented by our CEO. The Compensation Committee regularly reviews the total compensation obligations to each of our executive officers. During 2013,2014, the Compensation Committee retained Total Rewards Strategies LLC to provide compensation related consulting services. Specifically, the compensation consultant provided relevant market data, current trends in executive and director compensation and advice on program design. In accordance with its charter, the Compensation Committee may delegate power and authority as it deems appropriate for any purpose to a subcommittee of not fewer than two members.

Nominating and Corporate Governance Committee.

This committee held two meetings in 2013.2014. The purpose of the Nominating and Corporate Governance Committee is to evaluate the qualifications of director nominees, to recommend candidates for election as directors, to make recommendations concerning the size and composition of the Board, to develop and implement our corporate governance policies and to assess the effectiveness of the Board.

Nominations and Nomination Process

It is the policy of the Nominating and Corporate Governance Committee to consider individuals recommended by shareholders for membership on the Board. If a shareholder desires to recommend an individual for membership on the Board, then that shareholder must provide a written notice (the “Recommendation Notice”) to the Secretary of the Company at Stoneridge, Inc., 9400 East Market Street, Warren, Ohio 44484, on or before January 15 for consideration by thethis committee for that year’s election of directors at the Annual Meeting of Shareholders.

In order for a recommendation to be considered by the Nominating and Corporate Governance Committee, the Recommendation Notice must contain, at a minimum, the following:

| · | the name and address, as they appear on the Company’s books, and telephone number of the shareholder making the recommendation, including information on the number of common shares owned and date(s) acquired, and if such person is not a shareholder of record or if such common shares are owned by an entity, | |

| · | the full legal name, address and telephone number of the individual being recommended, together with a reasonably detailed description of the background, experience, and qualifications of that individual; |

| · | a written acknowledgment by the individual being recommended that he or she has consented to the recommendation and consents to the Company undertaking an investigation into that individual’s background, experience, and qualifications in the event that the Nominating and Corporate Governance Committee desires to do so; | |

| · | any information not already provided about the person’s background, experience and qualifications necessary for us to prepare the disclosure required to be included in our proxy statement about the individual being recommended; | |

| · | the disclosure of any relationship of the individual being recommended with us or any of our subsidiaries or affiliates, whether direct or indirect; and | |

| · | the disclosure of any relation of the individual being recommended with the shareholder, whether direct or indirect, and, if known to the shareholder, any material interest of such shareholder or individual being recommended in any proposals or other business to be presented at our Annual Meeting of Shareholders (or a statement to the effect that no material interest is known to such shareholder). |

The Nominating and Corporate Governance Committee determines, and periodically reviews with the Board, the desired skills and characteristics for directors as well as the composition of the Board as a whole. This assessment considers the directors’ qualifications and independence, as well as diversity, age, skill, and experience in the context of the needs of the Board. Directors should share our values and should possess the following characteristics: high personal and professional integrity; the ability to exercise sound business judgment; an inquiring mind; and the time available to devote to Board activities and the willingness to do so. The Nominating and Corporate Governance Committee does not have a formal policy specifically focusing on the consideration of diversity; however, diversity is one of the factors that the Nominating and Corporate Governance Committee considers when identifying candidates and making its recommendations to the Board. In addition to the foregoing considerations, generally with respect to nominees recommended by shareholders, the Nominating and Corporate Governance Committee will evaluate such recommended nominees considering the additional information regarding them contained in the Recommendation Notices. When seeking candidates for the Board, the Nominating and Corporate Governance Committee may solicit suggestions from incumbent directors, management and third-party search firms. Ultimately, the Nominating and Corporate Governance Committee will recommend to the Board prospective nominees who the Nominating and Corporate Governance Committee believes will be effective, in conjunction with the other members of the Board, in collectively serving the long-term best interests of our shareholders.

The Nominating and Corporate Governance Committee recommended to the Board each of the nominees identified in "Election“Election of Directors"Directors”" starting on page 5 of this Proxy Statement.

Compensation Committee Interlocks and Insider Participation

None of the members of the Board’s Compensation Committee served as an officer at any time or as an employee during 2013.2014. Additionally, no Compensation Committee interlocks existed during 2013.2014.

| 14 |

Communications with the Board of Directors

The Board believes that it is important for interested parties to have the ability to send communications to the Board. Persons who wish to communicate with the Board may do so by sending a letter to the Secretary of the Company at Stoneridge, Inc., 9400 East Market Street, Warren, Ohio 44484. The envelope must contain a clear notation indicating that the enclosed letter is a “Board Communication” or “Director Communication.” All such letters must identify the author and clearly state whether the intended recipients are all members of the Board or certain specified individual directors (such as the lead independent director or non-management directors as a group). The Secretary will make copies of all such letters and circulate them to the appropriate director or directors. The directors are not spokespeople for the Company and responses or replies to any communication should not be expected.

Transactions with Related Persons

There were no reportable transactions involving related persons in 2013.2014.

Review and Approval of Transactions with Related Persons

The Board has adopted a written statement of policy with respect to related party transactions. Under the policy, a related party transaction is a transaction required to be disclosed pursuant to Item 404 of Regulation S-K or any other similar transaction involving the Company or the Company’s subsidiaries and any Company employee, officer, director, 5% shareholder or an immediate family member of any of the foregoing if the dollar amount of the transaction or series of transactions exceeds $25,000. A related party transaction will not be prohibited merely because it is required to be disclosed or because it involves related parties. Pursuant to the policy, such transactions are presented to the Nominating and Corporate Governance Committee for evaluation and approval by the committee, or if the committee elects, by the full Board. If the transaction is determined to involve a related party, the Nominating and Corporate Governance Committee will either approve or disapprove the proposed transaction. Under the policy, in order to be approved, the proposed transaction must be on terms that are fair to the Company and are comparable to market rates, where applicable.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

20132014 Overview

During 2013,2014, the actions of the Compensation Committee (the “Committee”) and our pay-for-performance philosophy functioned such that compensation actually earned by our executives was aligned with our financial performance. Highlights from the year and our 2013 performance are as follows:

| · | On August 1, 2014, we completed the sale of substantially all of the assets and liabilities of our Wiring business. While the Wiring business sale resulted in a loss from discontinued operations of $9.4 million in 2014, we received cash of approximately $71.4 million which was used to deleverage the Company. The sale also enabled management to shift its focus entirely to the three remaining higher margin and more technology-driven business segments. |

| · | We transformed our capital structure in 2014 by refinancing our credit facility in September 2014, increasing our borrowing capacity by $100.0 million which provides flexibility to fund organic growth and potential acquisitions. We redeemed our outstanding $175.0 million 9.5% senior secured notes utilizing proceeds from the sale of the Wiring business and a $100.0 million borrowing on the credit facility. While redemption of the senior secured notes resulted in a loss on extinguishment of debt of $10.6 million, this debt refinancing is expected to reduce the Company’s interest expense annually by approximately $12.0 million. |

| · | We recorded a non-cash goodwill impairment charge of $51.5 million related to our PST segment due to a decline in its 2014 operating performance and expected lower future sales and earnings growth expectations resulting from continued weakness in the Brazilian economy and automotive market. |

| · | Net sales increased |

| · | Our Control Devices segment operating income increased over prior year due to increased sales volume and labor efficiencies, partially offset by higher design and development costs and selling general and administrative costs including higher product liability defense costs. The performance of our Control Devices segment was in line with our expectations for 2014. |

| · | Our Electronics |

| · | The performance of our PST segment fell well below our expectations for 2014. Our PST segment operating income decreased from prior year primarily due to the goodwill impairment charge, lower |

| · | Our |

As a result:

| · | Achievement under the annual incentive award was limited to the consolidated |

| · | Our |

Compensation Philosophy and Objectives

Our Company’s compensation programs for executive officers are designed to attract, retain, motivate, and reward talented executives who advance our strategic, operational and financial objectives and thereby enhance shareholder value. The primary objectives of our compensation programs for executive officers are to:

| · | attract and retain talented executive officers by providing a compensation package that is competitive with that offered by similarly situated companies; |

| · | create a compensation structure under which a substantial portion of total compensation is based on achievement of performance goals; and |

| · | align total compensation with the objectives and strategies of our |

We have a commitment to formulate the components of our compensation program under a pay-for-performance philosophy. A substantial portion of our executive officers’ annual and long-term compensation is tied to quantifiable measures of the Company’s financial performance and therefore will not be earned if targeted performance is not achieved, as demonstrated in the 20132014 Overview, above.

We established the various components of our 20132014 compensation payments and awards to meet our objectives as follows:

| Objective Addressed | ||||||||||||

Type of Compensation | Compensation | |||||||||||

Objective |

|

|

| |||||||||

| Base salary | ü | |||||||||||

| Annual incentive plan awards | ü | ü | ||||||||||

| Equity-based awards | ü | ü | ü | |||||||||

| Benefits and perquisites | ü | |||||||||||

Mix of Compensation

Our executive compensation is based on our pay-for-performance philosophy, which emphasizes executive performance measures that correlate closely with the achievement of both shorter-term performance objectives and longer-term shareholder value. A large part of our executive officers’ annual and long-term compensation is at-risk. The portion of compensation at-risk increases with the executive officer’s position level. This provides more upside potential and downside risk for more senior positions because these roles have greater influence on our performance as a whole.

Total Target Compensation

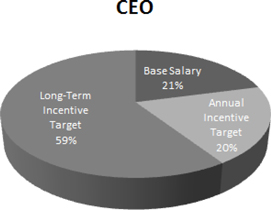

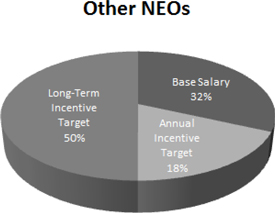

Total target compensation is the value of the compensation package that is intended to be delivered if performance goals are met. Actual compensation depends on the annual and long-term incentive compensation payout levels based upon the applicable performance achievement and, for long-term awards, the price of our common shares. The following charts show the weighting of each element of total target compensation for the CEO and the other Named Executive Officers (“NEO”). These charts demonstrate our pay-for-performance philosophy, as annual and long-term incentive compensation comprises the majority of total target compensation.

|  |

Determination of Compensation

Based on the foregoing objectives, weWe have structured our executive officers’ compensation to provide competitive compensation to attract and retain executive officers, to motivate them to achieve our strategic goals and to reward the executive officersthem for achieving such goals. The Committee historically retains an independent compensation consultant to assist the Committee. For 2013,2014, the Committee retained Total Rewards Strategies LLC (“TRS”) to assist the Committee with the following: keeping it appraised about relevant trends and technical developments during its meetings; providing consulting advice regarding long-term incentive and change in control arrangements; providing peer group analysis; and providing market data for the CEO position and other executive officers. Additionally, recommendations and evaluations from the CEO are considered by the Committee when setting the compensation of the other executive officers.

Our executive officers are eligible to receive two forms of annual cash compensation – base salary and an annual incentive award – which together constitute an executive officer’s total annual cash compensation. Please note that “total annual cash compensation,” as discussed in this Compensation Discussion and Analysis, differs from the “Total Compensation” column of the Summary Compensation Table on page 23,21, which includes long-term incentive, perquisites and other forms of compensation valued on a basis consistent with financial statement reporting requirements. The levels of base salary and the annual incentive award for our executive officers are established annually under a program intended to maintain parity with the competitive market for executive officers in comparable positions. Our executive compensation levels are designed to be generally aligned with the 50th - 75thpercentile of competitive market levels (using our peer group) for each position.

There is no pre-established policy or target for the allocation between cash and non-cash or short-term and long-term incentive compensation. Rather, the Committee reviews competitive market compensation information provided by our compensation consultant and considers the Company’s historical compensation practices in determining the appropriate level and mix of incentive compensation for each executive position.

Compensation Benchmarking and Comparator Group

The comparator group is comprised of some of our direct competitors and a broader group of companies in the electronic and motor vehicle parts manufacturing industries that the Committee believes is representative of the labor market from which we recruit executive talent. Factors used to select the comparator group of companies include industry segment, revenue, profitability, number of employees and market capitalization. The Committee reviews and approves the comparator group annually. The companies in the comparator group used in 20132014 executive compensation decisions were:

| Accuride | Drew Industries | Modine Manufacturing |

| Altra Holdings | Encore Wire | Richardson Electronics |

| American Axle | EnPro Industries | Spartan Motors |

| AMETEK | Esterline Technologies | Standard Motor Products |

| AVX | Gentex | Superior Industries International |

| CIRCOR International | Graco | Tennant |

| Commercial Vehicle Group | Kaydon | Titan International |

| CTS | KEMET | Trimas |

| Dana | Littelfuse | Wabash National |

| Dorman Products | Meritor |

In 2012,2013, the median sales revenue for the comparator group was $949 million$1.1 billion while our revenue was $939 million.$948.0 million, including the Wiring business which was sold in August 2014.

TRS provides the Committee with the 50thand 75th percentiles of the comparator group for base salary, cash bonus, long-term incentives and total overall compensation. The Committee uses as a primary reference point the 50th percentile when determining base salary and annual incentive targets and the 75th percentile when determining long-term incentive targets; each element of pay is adjusted to reflect competitive market conditions. The goal of the executive compensation program is to provide overall compensation between the 50th and 75th percentiles of pay practices of the comparator group of companies. Actual target pay for an individual may be more or less than the referenced percentiles based on the Committee’s evaluation of the individual’s performance and potential. Consistent with the Committee’s philosophy of pay-for-performance, incentive payments can exceed target levels only if overall Company financial targets are exceeded and will fall below target levels if overall financial goals are not achieved.

Consideration of Shareholder Advisory Vote on Executive Compensation

At our 20132014 Annual Meeting of Shareholders, our shareholders approved our compensation advisory resolution with 74%73% of the votes castshares entitled to vote approving the 20122013 executive compensation described in our 20132014 Proxy Statement. The Committee believes the shareholders vote affirms the Company’s approach to executive compensation and decided not to materially alter our compensation policies and programs for 2013.2014.

Elements of Compensation

TheIn 2014 the elements of compensation of our executive officers for 2013 were the following:were:

| · | Base salary; |

| · | Annual cash incentive award; |

| · | Long-term equity-based incentive awards; and |

| · | Benefits and perquisites. |

Although all named executive officers are eligible to participate in the same compensation and benefit programs, only Mr. Corey hashad compensation that is governed by an employment agreement. The terms of Mr. Corey’s employment agreement are described under “Employment Agreements.”

Base Salaries

We use baseBase salary asis the foundation of our compensation program for our executive officers. The annual cash incentive compensation awards and long-term incentive awards are based on a percentage of base compensation. The base salary is set at competitive market levels to attract and retain our executive officers. Base salary levels for our executive officers are set on the basis of the executive’s responsibilities, the current general industry and competitive market data, as discussed above. In each case, due consideration is given to personal factors, such as the individual’s experience, competencies, performance and contributions, and to external factors, such as salaries paid to similarly situated executive officers by like-sized companies. The Committee considers the evaluation and recommendation of the CEO in determining the base salary of the other executive officers. The Committee generally approves all executive officer base salaries at its December meeting, which become effective January 1 of the following year. Executive officers base salaries remain fixed throughout the year unless a promotion or other change in responsibilities occurs. For 2014, the Committee approved increasing Mr. Sloan’s base salary to a level that was reflective of the 50% percentile of competitive market data for his position. Prior to 2014, we paid the full cost of health insurance for our NEOs. Beginning in 2014, the NEOs contributed to their healthcare at the same level as all other employees, depending on the coverage they elected. To compensate for the elimination of this benefit, a one-time adjustment was made to increase each NEO’s competitive base salary for the amount of their healthcare coverage they are now required to contribute. The one-time adjustment was $2,500 for Mr. Corey and Mr. Sloan, $6,500 for Mr. Strickler, and $3,200 for Mr. Beaver. Mr. Adante does not participate in Stoneridge sponsored healthcare, therefore, no adjustment was necessary. The “Salary” column of the Summary Compensation Table lists the NEO’s base salary for 2013.2014.

Annual Incentive Awards

Our executive officers participate in our Annual Incentive Plan (“AIP”) which provides for annual cash payments based on the achievement of specific financial goals. As described above, the Company believes that a substantial portion of each executive’s overall compensation should be directly tied to quantifiable measures of financial performance. In February 2013,March 2014, the Committee approved the Company’s 20132014 AIP targets and metrics. In September 2014, the Committee approved restating the 2014 consolidated AIP targets to exclude the results of the Wiring business which was sold in August 2014. The AIP targets are expressed as a percentage of the executive officer’s base salary.

For 2013,2014, the structure of our AIP included both consolidated financial performance metrics and, where appropriate, divisional or functional focused metrics to incentivize specific performance. The financial performance elements, weighting, target metrics, and achievement for our NEOs are summarized as follows:

| Weight | Target Metric | Achievement | ||||||||

| For Mr. Corey & Mr. Strickler: | ||||||||||

| Consolidated Metrics including PST: | ||||||||||

| Operating profit | 60 | % | $50.1 million | 0 | % | |||||

| Free cash flow | 40 | % | $26.1 million | 0 | % | |||||

| For Mr. Adante & Mr. Beaver: | ||||||||||

| Consolidated Metrics excluding PST: | ||||||||||

| Operating profit | 60 | % | $41.6 million | 0 | % | |||||

| Free cash flow | 40 | % | $20.2 million | 102 | % | |||||

| For Mr. Sloan: | ||||||||||

| Consolidated Metrics excluding PST: | ||||||||||

| Operating profit | 18 | % | $41.6 million | 0 | % | |||||

| Free cash flow | 12 | % | $20.2 million | 102 | % | |||||

| Divisional Metrics: | ||||||||||

| Operating income | 42 | % | $31.7 million | 103 | % | |||||

| Free cash flow | 28 | % | $19.0 million | 133 | % | |||||

| Weight | Target Metric | Achievement | ||||||||||

| For Mr. Corey, Mr. Strickler, Mr. Adante and Mr. Beaver: | ||||||||||||

| Consolidated Metrics excluding Wiring Business: | ||||||||||||

| Operating profit | 60 | % | $39.7 million | 0 | % | |||||||

| Free cash flow | 40 | % | $2.5 million | 200 | % | |||||||

| For Mr. Sloan: | ||||||||||||

| Consolidated Metrics excluding Wiring Business: | ||||||||||||

| Operating profit | 20 | % | $39.7 million | 0 | % | |||||||

| Free cash flow | 10 | % | $2.5 million | 200 | % | |||||||

| Divisional Metrics: | ||||||||||||

| Operating income | 35 | % | $31.7 million | 113 | % | |||||||

| Free cash flow | 25 | % | $19.0 million | 91 | % | |||||||

| Asia Pacific operating income | 10 | % | $0.3 million | 76 | % | |||||||

The consolidated and divisional financial performance target metrics were based on our 20132014 business plan, excluding the results of the Wiring business, and were intended to be aggressivechallenging but achievable based on industry conditions known at the time they were established. Under the 20132014 AIP, the minimum level for achievement for the consolidated and divisional financial metrics was based on 80% of target while the maximum level was based on 130% of target. The following table provides the 20132014 AIP target as a percent of base salary, as a dollar amount and the dollar achievement for our NEOs:

| Target Percent of Base Salary | Target | Achieved | Target Percent of Base Salary | Target | Achieved | |||||||||||||||||||

| John C. Corey | 95 | % | $ | 665,000 | $ | - | 95 | % | $ | 687,325 | $ | 549,860 | ||||||||||||

| George E. Strickler | 70 | % | 250,250 | - | 70 | % | 262,290 | 209,832 | ||||||||||||||||

| Thomas A. Beaver | 50 | % | 150,000 | 61,200 | 50 | % | 154,600 | 123,680 | ||||||||||||||||

| Richard P. Adante | 50 | % | 118,125 | - | 50 | % | 118,125 | 94,500 | ||||||||||||||||

| Michael D. Sloan | 55 | % | 133,870 | 124,151 | 55 | % | 163,625 | 147,028 | ||||||||||||||||

For each performance metric, specific levels of achievement for minimum, target, and maximum were set as described above. At target, 100% payout is achieved for each element of the plan; at maximum, 200% payout is achieved; and at minimum, 50% payout is achieved. Below the minimum, target, no incentive compensation is earned. The AIP prorates incentive compensation payout earned between the minimum and maximum levels. At its discretion due to the underperformance of our Wiring segment, the Compensation Committee determined that no AIP would be paid to Mr. Adante.levels is prorated. The payment of compensation under the 20132014 plan was subject to our overall performance and is included in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table.

Long-Term Incentive Awards

Under our Long-Term Incentive Plan (“LTIP”), all executive officers may be granted share options, restricted common shares and other equity-based awards. Under our Long-Term Cash Incentive Plan (“LTCIP”), all executive officers may be granted awards payable in cash. We believe that long-term incentive awards are a valuable motivation and retention tool and provide a long-term performance incentive to management. The long-term awards are calculated based on the fair value of the shares, shares equivalent or cash at the time of grant. In 2013,2014, all long-term awards were granted under the LTIP.

The percentages are typically representative of the competitive market data obtained during the annual compensation review process described above. For 2013,2014, the Committee reaffirmed that in order to remain competitive in the overall compensation packages, the long-term incentive awards should approximate the 75th percentile of comparative market data. The expected awards are subject to adjustment based on differences in the scope of the executive officer’s responsibilities, performance and ability.

Long-term equity-based incentives are an important tool for retaining executive talent. For 2013,2014, we granted to our executive officers time-based restrictedshare units, or the right to receive common shares, under the LTIP equal to the equivalent of 60%50% of the fair value calculation based on the 75th percentile of comparative market data. If the executive officer remains an employee at the end of the three year vesting period, the time-based restrictedshare units will be earned and common shares will vest and no longer be subjectissued to forfeiture on that date.the executive officers. The grant date fair value of the time-based restricted common sharesshare units is included in the “Stock Awards” column of the Summary Compensation Table. The time-based restricted common sharesshare units awarded in 20132014 are included in the “All Other Stock Awards” column of the Grants of Plan-Based Awards table.